Yesterday the President sent out an email telling homeowners to only believe MCA sent info because all other info might be misinformation. It was followed later by an email from the MCA Treasurer which included two documents designed to sell the contract they negotiated with Benderson Development to Homeowners.

The analysis of those two documents below has been reviewed and approved by two CPA’s.

“Financial Impact” document is complete nonsense

This document claiming initial financial gains of $6 – 7 million (and $2.5 – 4 million after that) from the deal are completely misleading. The “financial gains” are primarily made up of two items: Operating savings from golf and Debt Service Reduction.

Operating savings from golf ($1.5 million/year): In our Budget Post, we explained how the $1.5 million loss per year from operating golf is a trumped-up number to make the Benderson deal look good, and that is exactly how it is being used here.

And NO ONE wants or expects the MCA to be the ongoing golf course operator for years going forward. But that is exactly what this document assumes. This number is nonsense for one year let alone using it for every year going forward. But the Treasurer includes it as “Savings” every year.

This is really, really misleading stuff.

Debt Service Reduction ($750,000 per year): This mostly deferring repayment of our debts (not interest rate savings). Minimizing debt repayments doesn’t make the remaining debt go away. Not paying your debts off is in absolutely no way a “financial gain”. If you don’t make your mortgage payment, are you “saving money”? Of course not. You still have to pay it later PLUS INTEREST.

The Treasurer mentions there will be a balloon payment in 7 years, but doesn’t say that THE BALLOON PAYMENT WILL BE $4.6 MILLION! Is that not important information for Homeowners? The Treasurer clearly knows the debt has to be paid later but still presents the payment deferral as a “financial gain”.

This is really, really misleading stuff.

Tax on $3 million from sale of Conservation Easements: The Treasurer adds a footnote that the $3 million is taxable but avoids stating the tax amount. It is a very simple calculation: taxed at 21%, so the tax will be $630,000 (Footnote 2).

The tax expense would be reported in our 2026-2027 results, so it’s omission from the 2026-2027 budget is ANOTHER BIG BUDGET ERROR.

This is really, really basic accounting and disclosure stuff.

New Revenue: This is small potatoes but such a glaring error that it needs to be noted. Contract calls for the lease rent to start at $50,000 and increases by a maximum of 3% per year. 3% increase on $50,000 = $1,500, so the next year’s payment would be $51,500. The Treasurer has it increasing $6,000 per year (=12% increase). It is not a one-time typo: the $6,000 increase is repeated the next year too.

This is really, really basic math stuff.

“Fixing” by hiding the BIG errors we identified (and told the Treasurer)

In a post we shared 3 weeks ago (2026-27 MCA Budgets have BIG assumptions and errors) we noted that the Treasurer had made 2 major errors in the “with lease” budget which netted to $665,800. These were explained to the Board PRIOR to passing the budget. The Treasurer denied this error at the time and brought it up out of the blue at the next meeting just to deny it again. The budget was passed with these errors.

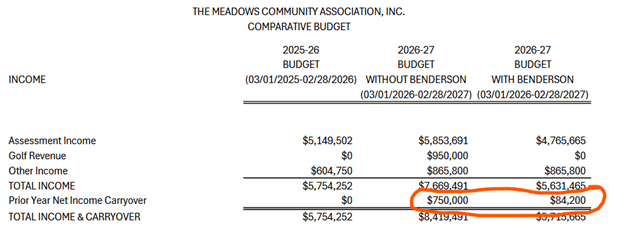

But the “comparative budget” they sent out today makes it clear our analysis was correct to the penny. There is an unexplained/unauthorized change that the Treasurer slipped in to what the Board approved (Footnote 1). It is circled in red below. This is what accountants refer to as a “plug” to get a desired result. And look how much the plug adjustment is: $665,800! (750,000 – 84,200 = 665,800).

It is a good thing that the Treasurer has finally recognized their error, but why not just acknowledge it to the Board and Homeowners, and move on?

The good news is that the (unauthorized) adjustment removes most of the spending of our saved equity (which was another significant concern we expressed). That is the adjustment that we hoped would happen when the error was inevitably corrected.

[Sorry if our frustration boiled over a bit on this post. But getting an email from the President saying only believe what we tell you, followed by an email from the Treasurer with VERY misleading info, was just too much]

Please consider attending the Meadows Community Info Meeting – TODAY @ 6pm. This is a resident run meeting to share information on the contract with Benderson Development proposed by the 3 officers who negotiated it (based on the info in the Board’s summary of the deal). The President’s email gave the meeting a nod but didn’t provide the time and location (click the link above for that info).

Join the “For The Meadows” owners-only Facebook group to discuss MCA governance and operations.

Footnote 1

To be clear the Treasurer is presenting a “Budget with Benderson” that is different than the Board actually approved. Yet another example of the 3 officers making decisions they do not have the authority to make.

Footnote 2

The tax on the gain could be as high as $900,000 if the MCA doesn’t make changes to how it reports to the IRS (file using form 1120 rather than 1120-H). That change should have made last year and we paid an extra $13,000 of income tax because it wasn’t. If it isn’t made this year we’ll pay even more unnecessarily. And if it isn’t made for next year we could pay an extra $270,000 in taxes.

Leave a comment