NOTE: This post was created by Joe Moore during his 2023 MCA Board member campaign.

Under our current governing documents the MCA has total control over the budgeting and spending process. During the past 5 years we spent more than $10 million managing the day to day operations. Another $13 million was spent to buy new assets for the community, of which, $6 million was spent to buy the TMCC property in 2018. As part of their responsibility, the MCA board oversees and approves a one year operating budget for each new fiscal year. This is done about 3 months before the new fiscal year begins. At that time, each homeowner is sent a copy of the budget for their information.

In my professional career I became accustomed to developing a Financial Plan that included an operating budget for day-to-day operational expenses and a Capital Budget for spending to support future growth and asset replacement needs. It worked very well for our company and I became convinced that it was the right way to run a business. By the way, this type of planning and budgeting is very common in the business world.

I decided to run for the MCA board because I have suggested such a plan to our board with no response. I promise, if elected, to work hard to see a 5-year Financial Plan implemented. This plan would include:

- A plan summary that includes two years of actual (audited) revenue and spending with a three year plan of revenue and spending.

- A one year detailed operating budget that matches the audit report for operating revenue and spending.

- All spending is broken into two categories, the cost to run the day-to-day operations and the cost to make major or periodic improvements to the infra-structure (capital projects).

- A summary of our financial health that includes a forecasted year ending cash balance and our outstanding debt.

This planning process is common with many businesses and the way many people manage their personal finances (although we may not realize that fact).

Now, consider the following hypothetical plan presented as I have described.

This plan could be developed, discussed, and voted on by the board in November or December. The homeowners would receive the Financial Plan with their assessment and ballot in January. The ballot used to elect new board members could be used to approve the plan. This would help make board members running for re-election to be held accountable for their vote on the Financial Plan..

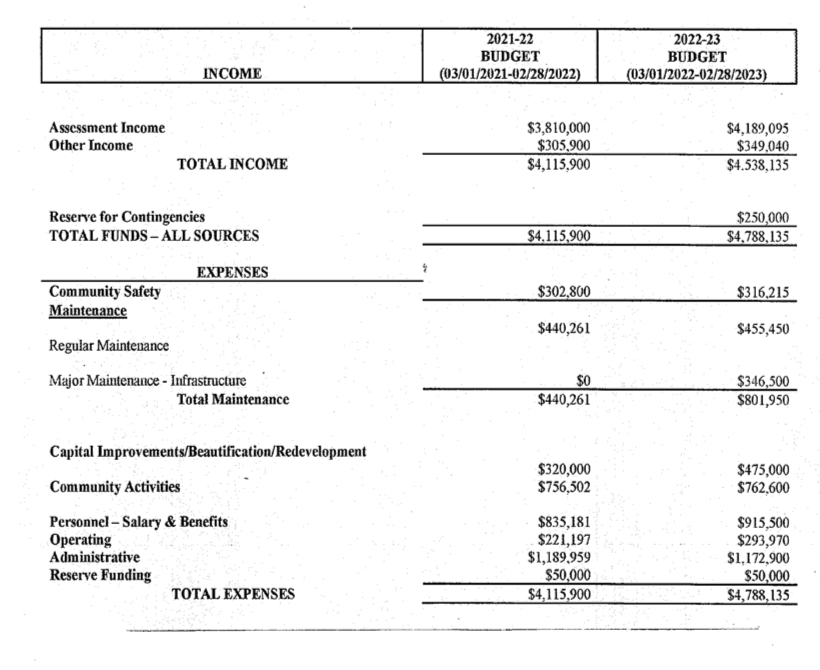

By comparison, the following chart was distributed to each homeowner last January with the assessment invoice for their property. As you review this document you will notice it is pretty confusing even though it is easier to understand, as compared to similar documents distributed in previous years.

When I first received this budget, four questions came to mind.

- How does Major Maintenance differ from being a Capital Improvement?

- How much does it actually cost to run the day-to-day MCA operation?

- What capital projects (improvements lasting one year or more) are we planning to do and what are the expected costs of each?

- Our Renaissance card cost $600,000 per year. Why is such a major expenditure buried in Community Activities?

In summary, I believe this proposed financial plan will enable any homeowner to easily understand the reasons for our assessment going up or down, the changes being made in the community, and the ability to influence future actions of the board moving forward.

Leave a comment